Difference between revisions of "Never Split Tens"

Drlesmgolden (talk | contribs) |

Drlesmgolden (talk | contribs) |

||

| Line 84: | Line 84: | ||

[[File:Taxincentives.jpg|thumb|center|600px|<small> The Illinois income tax credit and federal income tax deduction basis for funding of <i>Never Split Tens</i>. </small>]] | [[File:Taxincentives.jpg|thumb|center|600px|<small> The Illinois income tax credit and federal income tax deduction basis for funding of <i>Never Split Tens</i>. </small>]] | ||

| + | |||

| + | NOTE: If the Table is not visible in your browser, go directly to the Table here:</br>[[Media:Taxincentives.jpg]] | ||

===Investor Share of Profits=== | ===Investor Share of Profits=== | ||

Revision as of 14:32, 28 May 2013

Never Split Tens is a major motion picture based on the life of the mathematician who developed the card counting technique for the casino game of blackjack. Its production budget will be raised by loans taking advantage of Illinois income tax credits and federal income tax deductions.

The Motion Picture

Logline: When an eccentric M.I.T. math professor develops a computer system for winning blackjack and tests it with mob-backed money in casinos, he loses his wife and job but redeems himself when his huge winnings cause a revolution in the casino industry. Based on a true story.

Motion pictures can be characterized as plot driven ("Body Heat" and "The Sting"), by their setting ("Star Wars" and "Harry Potter"), or character driven ("A Beautiful Mind" and "Catch Me If You Can"). This motion picture is character driven. As a result, Never Split Tens will be casting A-list actors in the roles of the protagonist, his wife, and the gangster. This will attract distributors in all modes, box office, electronic, and ancillary (please see Section Investor Share of Profits below).

Production Funding by Income Tax Credits and Deductions

The funding mode is a concept that professional accountants could suggest to clients to whom they provide tax savings advice. This concerns earning substantial Illinois motion picture production income tax credits (35 ILCS 16/) and federal motion picture production income tax deductions (U.S.C. 181).

Much of the producers’ understanding of this "loan-investment" scenario came from an accounting firm which is on the list of the Illinois Film Office as those who purchase tax credits from film production companies.

Usual Funding Modes

In the usual case, the film company obtains the tax credit after completion of filming. Our concept is to reverse the scenario: The producers of Never Split Tens will be obtaining a tax credit and are seeking an entity or individuals to provide a loan based on that tax credit as collateral before production begins. Accountants are encouraged to suggest this concept to their select clients seeking substantial no-risk tax savings.

Funding for Never Split Tens

Proposal

The producers request a $2.9 million loan for up to eight months from those with large state and federal tax liabilities to whom you provide professional accounting and investment advice. The collateral items are related to:

a) Illinois tax credits based on 35 ILCS 16/, and

b) federal tax deductions based on U.S.C. 181.

The loan will provide a significant portion of the production costs of the filming of a major motion picture in Illinois in the popular casino gambling genre. The eight month period results from a projected five month filming period and a two to three month period for receipt of the Illinois tax credit from the Illinois Film Office after filming has been completed.

Please note that the request of $2.9 million, while based on a preliminary production budget estimate, is for illustrative purposes. The actual amount requested will result from an audit by the Illinois Film Office of the production budget. This will determine the actual amount to be spent in Illinois.

The producers calculate below an annualized 35% return using a federal tax bracket of 20% and an annualized return of 58% using a federal tax bracket of 35%. These surprisingly large returns result entirely from state and federal government investment incentive programs.

Unlike many other vehicles, the tax benefits of film production are independent of whether or not the film makes a profit. They result solely on expenditures during production being made in the state of Illinois and the United States.

Illinois Tax Credit

By 35 ILCS 16/ -- Film Production Services Tax Credit Act of 2008, films shot in Illinois are provided a 30% tax credit of the production costs spent on Illinois residents, firms, and vendors. The tax credits are transferable and can be carried over five years. About forty states have similar tax incentive programs, to reverse the flight of film production to Canada and now increasingly to Mexico.

An additional credit is provided equal to 15% of the salaries of at least $1000 of residents living in economically disadvantaged areas. For the purposes of this proposal, we will not include this additional tax credit in our calculations.

Although a reading of the below may indicate that the returns are "too good to be true," the returns result from government investment stimulation policy. As 35 ILCS 16/ states:

Film Production Services Tax Credit Act of 2008. Section 5. Purpose. The General Assembly finds that the Illinois economy is highly vulnerable to other states and nations that have major financial incentive programs targeted to the motion picture industry.

The Act can be accessed at --

http://www.ilga.gov/legislation/ilcs/ilcs3.asp?ActID=2972&ChapterID=8

The elements of the Act are summarized at the Illinois Film Office website --

http://illinoisfilm.biz/index.php?option=com_content&view=article&id=11&Itemid=2

The current administrator of the program is

Ms. Michele McGee, Tax Credit Specialist

Illinois Film Office

100 W. Randolph Street

Chicago, Illinois 60601

312-814-7162

Michele.McGee@illinois.gov

Example

A film company spends $10 million in Illinois in 2013. They obtain a 30% or $3 million tax credit. That credit can be transferred to any entity which has an Illinois tax liability and, assuming the film production occurred in 2013, it can be broken up into credits from tax year 2013 through 2017. This is not a deduction; it is an actual tax credit.

In the usual scenario, film companies obtain payment of the tax credit from the state of Illinois after production is completed, sell those credits through a broker, and use the proceeds to cover post-production expenses such as editing, sound dubbing, and deferred A-list actor salaries (usually combined with points on the film profits). The credit is provided by the state to the producer after auditing, within 2-3 months of the termination of film shooting. As a result, if the film takes 4-5 months to shoot, the credit is provided by Illinois within 6-8 months of the beginning of shooting.

In this frequently employed financing scenario, the film company faces two problems,

1. the source of the initial production funds, and

2. the large middle-man broker fees.

The producers of Never Split Tens are reversing the scenario. They will be obtaining a tax credit and are looking for an entity or individuals to provide a loan based on that tax credit as collateral before production begins.

The producers therefore wish to approach those with large Illinois tax liabilities. Either corporations doing business in Illinois or attorneys in large firms are appropriate fits. Some of these have large incomes, large tax liabilities, and are associated with a significantly large number of partners. The appropriate manner by which to approach these groups is through their advising accountants.

Example

The producers budget spending $10 million in Illinois. The loaning entity or individuals provide a loan of $2.9 million. After six to eight months, Illinois provides our production company the $3 million tax credit which is then transferred to the loaning entity or individuals. With that $100,000 paid back in interest, the earnings on the loan is $100,000/$2,900,000 x 100 = 3.4% for eight months, equivalent to 5.2% interest annualized. (Note: The full payment comes from the Illinois tax credit, not the production company, and therefore the "interest" is not income.)

Federal Deduction

Film production costs, by U.S.C. 181, are deductible: Investments in a motion picture filmed in the United States are 100% tax deductible for the investor in the year of investment. The motivation, again, is to reverse the flight of film production to Canada and now increasingly to Mexico.

The Illinois film office, our accountant, and our entertainment lawyer agree that the amount of money loaned can be considered an investment under U.S.C. 181.

Example A

If a single corporation provides the entire loan, its loan-investment of $2.9 million results in a $2.9 million federal deduction. For those in, for example, the 20% tax bracket, this results in a tax savings of $580,000. The earnings on the loan from this source is $580,000/$2,900,000 x 100 = 21% for eight months, equivalent to 31% interest annualized.

Example B

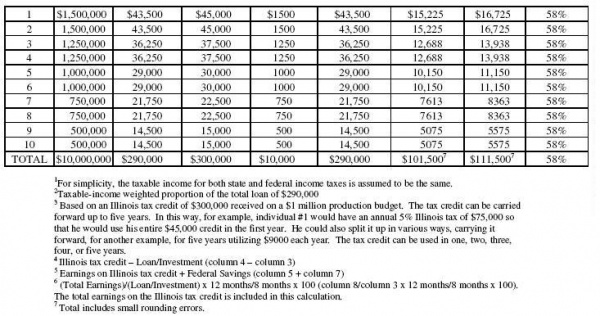

In this example, ten individuals provide the loan based on their relative gross incomes. The results for their considerations based on both the Illinois tax credit and the federal deduction are provided in the table. The individuals are assumed to be in the 35% federal tax bracket. The annualized return resulting from the total of the Illinois tax credit and the federal deduction is 58%.

NOTE: If the Table is not visible in your browser, go directly to the Table here:

Media:Taxincentives.jpg

In addition, as investors, the loaning entity or individuals would receive a percentage of the profits earned by the film. The film will be distributed in all modes, for domestic and international box office, in electronic media, and in ancillary distribution (such as in prisons, cruise ships, summer camps, colleges and universities, and on airline flights).

The majority of motion pictures do not earn a profit solely from domestic distribution. The percentages of the box office taken by the domestic exhibitors (theatre owners), distributors, and agents are significant. Most profitable films earn their profits from international box office, electronic media, and ancillary distribution. These revenue streams are realized within a year of theatrical release to ten to fifteen years after theatrical release. Statistics of movie profitability demonstrate that character-driven films, because of their casting A-list stars, are attractive to exhibitors and distributors because they have the best chances of attaining profitability in the long run.

Production and Compliance

The success of this project and the viability of its presentation to clients by an accountant firm requires that the producers guarantee that the funds loaned to the production company are appropriately spent. Therefore, numerous steps will be taken to ensure compliance with 35 ILCS 16/.

a. The producers create a detailed production budget using film industry standard line production software,

b. That budget is submitted to the Illinois Film Office. Their auditor determines those expenses attributable to Illinois residents, firms, and vendors and issues a letter of pre-production approval in which that amount is provided to the dollar,

c. That sum less an agreed-upon percentage is requested as a loan by the producers,

d. During the actual filming, the coordinating producer, working with the production company accountant, ensures that the residents, firms, and vendors reside or do business in Illinois. Appropriate paperwork and receipts are compiled daily,

e. During the actual filming, the coordinating producer, working with the production company accountant, provides a daily accounting of the expenses related to these residents, firms, and vendors,

f. That accounting is provided to the accountant firm daily.

Summary

For an up to eight month loan of $2.9 million, the loaning entity or individuals receive $3.0 million (Illinois income tax credit) + $2.9 million (Federal income tax deduction) = $5.9 million in consideration. Based on a 20% corporate federal tax bracket, the net "earnings" are $100,000 + $580,000 = $680,000. That yields an annualized 35% return on the $2.9 million. Based on a 35% individual federal tax bracket, the return is equivalent to an annualized 58% return.

Please note that neither the state nor federal tax credit/deduction is based on the motion picture earning any profits. They result solely on expenditures during production being made in the state of Illinois and the United States.

In addition, as investors, the loaning entity or individuals would receive a proportion of the profits earned by the film. The film will be distributed in all modes, for domestic and international box office, in electronic media, and in ancillary distribution.

Strict compliance with the terms of 35 ILCS 16/ is assured by daily accounting during the filming of the motion picture.

The producers’ entertainment lawyer has drafted a complete prospectus if you wish to receive a copy. This highlights the risks of investment in film production, but as noted the state and federal tax benefits of the loan are independent of whether or not the film makes a profit. The prospectus would provide information on the potential profitability of the motion picture.

The producer, with their attorney, would be happy to discuss this proposal further with accountant firms and their counsel at their convenience. A representative of the Illinois Film Office would be happy to attend.

Contact

Leslie M. Golden

Executive Producer

"Never Split Tens"

708-848-6677

drlesgo@aol.com